As they’re living with their parents because they can’t afford an apartment of their own.

Do we REALLY need to quiz people to know this? Ffs.

People really love quizzes.

Don’t worry though we solved inflation. We just removed it from our calculations. If we don’t count it: it’s not there!

Investment funds stocking up on US farmland in safe-haven bet

Investment funds have become voracious buyers of U.S. farmland, amassing over a million acres as they seek a hedge against inflation and aim to benefit from the growing global demand for food, according to data reviewed by Reuters and interviews with fund executives.

The trend worries some U.S. lawmakers who fear corporate interest will make agricultural land unaffordable for the next generation of farmers. Those lawmakers are floating a bill in Congress that would impose restrictions on the industry’s purchases.

Though their acreage is a small slice of the nearly 900 million acres of U.S. farmland, the pace of acquisitions by investment firms like Manulife Investment Management and Nuveen has quickened since the 2008 global financial crisis drove firms to seek new investment vehicles, according to Reuters interviews with fund managers and an analysis of data from the National Council of Real Estate Investment Fiduciaries (NCREIF).

The number of properties owned by such firms increased 231% between 2008 and the second quarter of 2023, and the value of those holdings rose more than 800% to around $16.2 billion, according to NCREIF’s quarterly farmland index, which tracks the holdings of the seven largest firms in farmland investment.

Farmland offers steady returns even in periods of high inflation, and firms hope crop demand will remain steady as the United Nations predicts the world will need 60% more food by 2050 due to population growth.

You don’t want to confuse “inflation” with “economic growth”. One makes prices go up because the evil bad salaries are increasing. But the other makes profits go up because of the smart efficient business net revenues are increasing.

A prosperous nation needs big new investments in the future. And that means speculating in our domestic breadbasket, so we can maximize the price of inelastic commodities in an effort to optimize consumption habits. You don’t like waste, do you? Optimizing price reduces waste. Its all right here in the book Basic Economics by totally non-problematic and very smart guy Thomas Sowell.

hey rich people, ever heard the stories of what happens when the mass working class gets hungry?

They vote for the very people that aim to make them poorer?

Rephrased: 54% of young Americans live with their parents or in large communal housing and still struggle to afford food.

42% are in school or are unemployed. 28% are working part time.

Yeah, food is the only real expense when you’re at home or in a dorm and not paying those student loans yet.

It has been a long time since people only lived at home because they didn’t have real jobs or are in school. Many are also likely to need cars so they can get to work (because most places in America you need a car), there is a decent chance they are paying for some amount of healthcare out of pocket as well. Rent is unaffordable as hell.

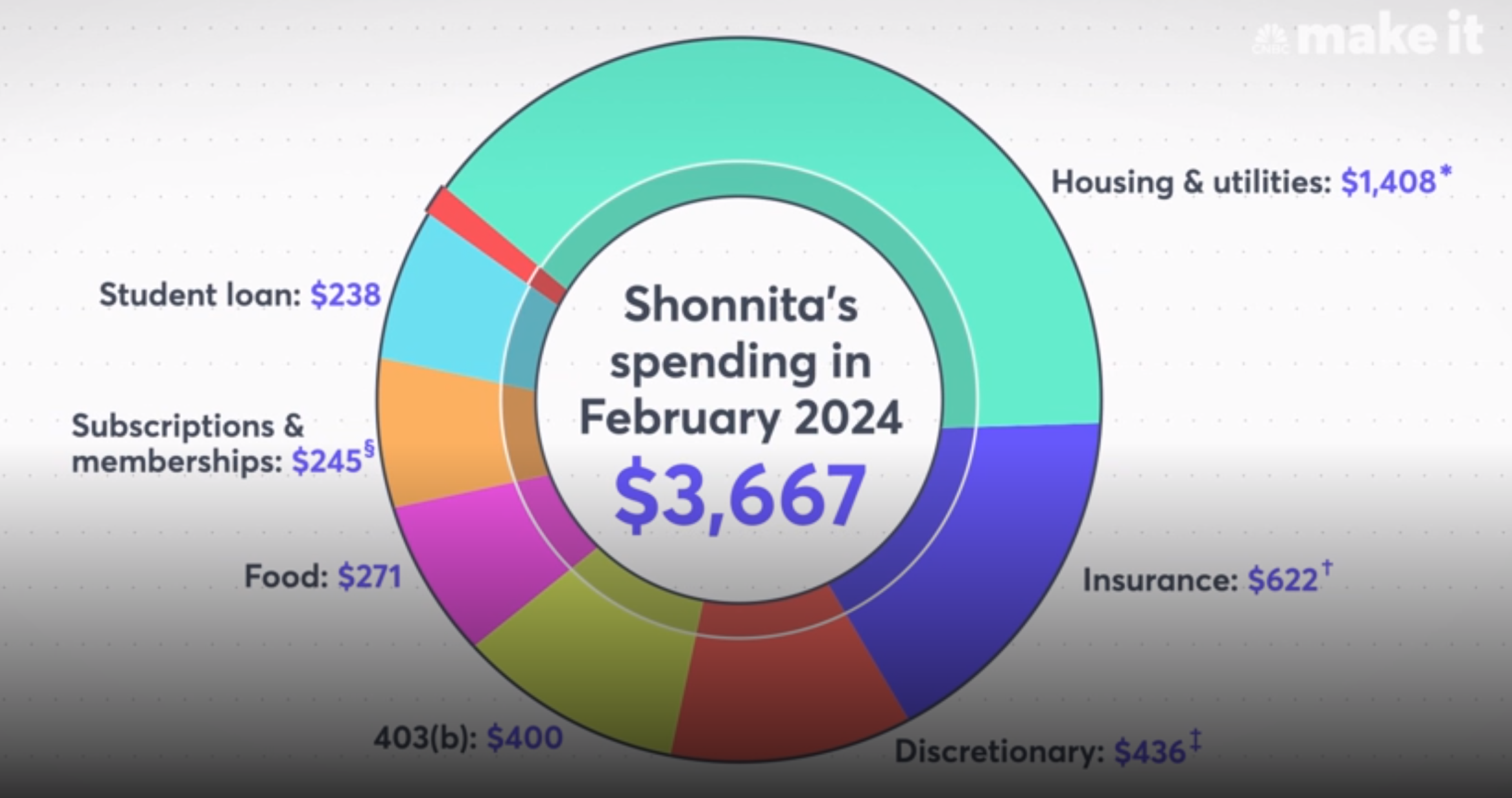

To follow up with this… they have a stupid video on their page where they break down expenditure of a girl in Houston who makes 65k. Insurance and rent takes half. Food is minimal at $271

Man, I don’t know what I’d do without Aldi. Ironic that the best grocery chain in America is European, when the American Grocery Store used to be such a symbol of U.S. prosperity.

Same here. Aldi is the only place with affordable healthy food in my area. If it closed, then I’ll have to shop at garbage Walmart…

Shit’s bad in Canada, and our grocery store megacorps are taking us for all we’ve got. Five boneless skinless chicken breasts for $28 is insanity. Yet here we are.

I went to get chicken for some meal prep a couple of days ago (Missouri, US) and a 1lb container of just chicken breast tenders costs $13, I figured it was a “labor” cost for cutting the tenders off before the customer buys it, like how a container of diced onion costs an order of magnitude higher than just buying a whole onion, but nope, the pack of 2 breasts right next to it cost basically the same, maybe only 50 cents cheaper, and I wasn’t in anything expensive like a whole foods, just a generic lowcost midwest regional store. It’s absolutely ridiculous. Not to mention 2 orange or red bell peppers costs $5…

Chicken tenderloins are $3.94/lb at Walmart in Central KY. Where were you shopping?

This was at a Price Chopper in western central MO

Tyson announced several months ago that they were cutting back supply, just so that they could charge more. They’re one of, if not the largest chicken supplier (and they are fully vertically integrated) in NA, so them raising prices affects prices across the board.

Prepare for more pain as bird flu seems to be spreading in US cattle populations.

$3/lb for boneless antibiotic free chicken breasts here in Massachusetts. https://www.shopmarketbasket.com/sites/default/files/weekly-flyer/pdfs/2024-05/mb-flyer-May5-May11-2024_web.pdf

Yeah no shit

I make way more than I did in my 30s (53 now) but I feel way poorer. Of course my mortgage payment is more than 3x what it was back then … that might be a reason.

The fact you can afford mortgage and a home blows my mind and I’m 40. I have no hope in hell of ever owning and I make decent money

If I lived in someplace like Silicon Valley California and making what I make I’d be homeless. Someplaces are better than others. But the system is definitely rigged for sure.

Not really surprising.

yep. to anyone who is paying attention. and lives in a HCOL area.

but a lot of people aren’t/don’t.

Considering only 30% of the people in this survey from ages 18-34 are working full time, i’m going to go ahead and say this isn’t an accurate representation of independent young adults.

26% are in school and 16% are unemployed for a total of 42% not really making money / are using loans for housing or are living at home.

28% are working part time and are unlikely to be living on their own - it’s rare to find a part time gig that can afford housing.

So 22% think housing is the highest cost issue… and only 30% are employed full time… sounds about right to me! I’m guessing it’s not 30% because those 8% got mortgages during the 4% or lower interest rate era.

You know chit don’t seem right when your groceries alone, not even including fast food / restaurant dining, is about the same if not more than your mortgage payment.

Now that AI tech is going full swing in implementation across multiple industries in the U.S., prepare for stagflation.

Historically, stagflation occurs when high unemployment, slow economic growth and high inflation all happen at the same time. Powell compared today’s economy, with both inflation rates and the unemployment rate below 4%, to that of the 1970s, the decade when most economists consider stagflation to have taken root. May 1, 2024

deleted by creator

All that avocado toast shakes fist

My total food bill is almost a $1000. I’m single and live in a city.

65% of it is groceries. Nothing fancy. It costs me $150 a week for the basics. Veggies, few lbs of meat, dairy etc.

Could I cut back and only eat rice and canned/frozen foods? Yes. But I want to eat good fresh food. I drop about $50 in produce a week alone.

So you spend $400/month on restaurants?

$150 x 4 = $600/month.

That lines up with the ‘65% of it is groceries’ part. 35% of almost $1000 is a bit shy of $350.

That’s a lot of take out.

That’s eating out like every other day. I eat out maybe every other week.

No, just over $1100 for the month. This of course includes, ever so often things like cleaning supplies, and toiletries.

deleted by creator

Assuming you’re in the US, that’s either a really cheap mortgage or a huge family. Where are you seeing grocery expenses exceed mortgage payments?

They should boycott.

Sounds about right.

shocked pikachu