Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

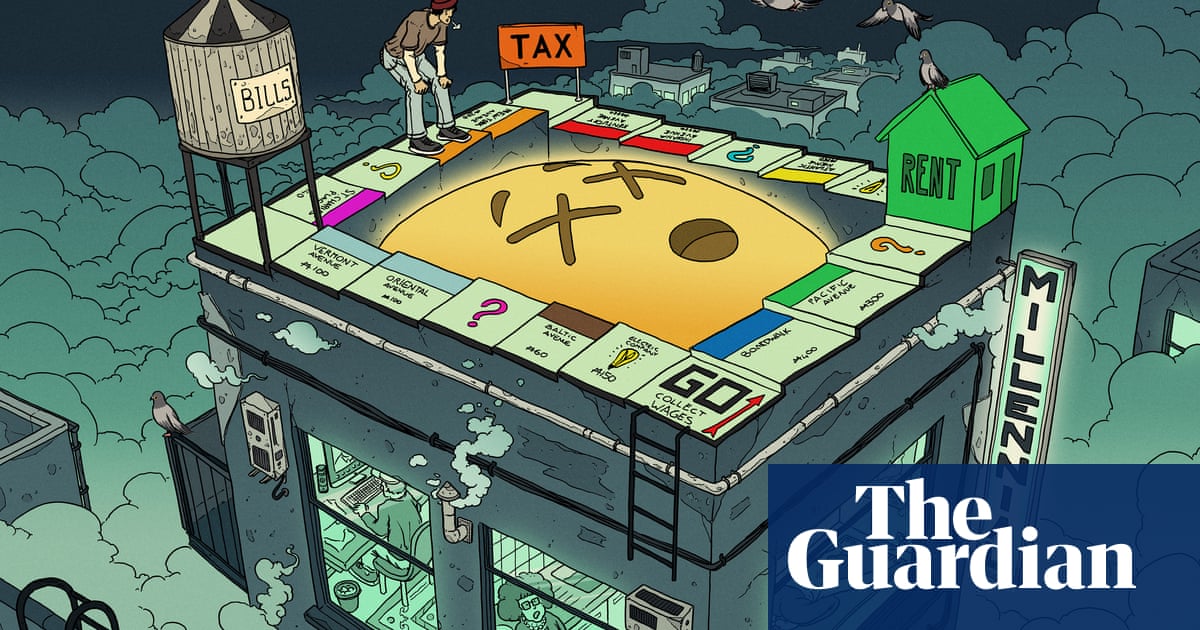

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

My wife has a job with an awesome pension and as a result there is basically no situation she will ever leave. I pointed out to her that the golden handcuffs are still golden.

One day some MBAs are going to learn that if you don’t want constant turn over you give workers a pension so great they would crawl over their mother’s corpse to get it.

What am I saying? MBAs learning? Hahaha I love being silly.

deleted by creator

Unfortunately, living in the US, I would not take a job with a pension because the (private) pension system cannot be trusted. I remember the 00s when many company pension accounts went bankrupt, because companies were no longer offering it as a benefit and it was easy enough to screw over retired past employees. Companies would take poorly performing divisions and their pension plans, spin them off as a new company that would quickly file for bankruptcy.

I would not trust a pension without it being insured by an organization like the FDIC. Even then, I would be afraid that my pension would not cover living costs due to inflation.

Luckily there are alternatives. I have a 401k, which should give me a steady flow of inflation proof dividends… until a market downturn wipes it out. If that happens, I can fall back to Social Security. Don’t believe the baloney that the government will ever let Social Security go bankrupt. They will just cut down benefits.

I don’t deny things like that happened. You heard about them right? So did I. But that’s the thing, these are the stories you heard. It’s man bites dog, it is observation bias.

Also her pension is insured. And I am pretty sure the bankruptcy thing you mentioned was one particular case with a car part maker.

I searched what MBA actually means. Fuck that shit. Degree in “Business Administration” sounds like degree in praying. Wait, there is one! Fuck!

It doesn’t matter if any specific MBA learns a lesson. Some other douche canoe will swing by and have their single brain cell fire off just this one time and they’ll start hacking away at the pensions to make Q3 look better.

Boeing style.

No more moon shots, contract out everything, slash pensions, fight a war against your union, move corporate away from production, buy your own stock.

I’m a late gen-Xer (born in '80, so I’m more of a “Xennial”). I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire. I feel horrible for all those who are in a worse financial situation than me, but we are all really fucked in the next 20 years.

I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire.

If this is your reality, there’s more wrong with your expectations than your situation.

Social Security is set to run out in the 2030s, and I fully expect the stock market to crash, effectively wiping out my 401k. As others have mentioned, resources like water will start to become scarce, inciting instability.

SSI isn’t set to run out. It will have to be reduced if they don’t take the income cap off of it, however.

But all the other things you said will happen.

Correct. IIRC there’s an auto mechanism that will cut all benefits by 23% or something. So you’re mom/dad getting $2,000 a month would now only get about $1,500.

If you think the stock market crashing wipes your 401k to 0 and that’s realistic you need to get your head checked.

In 2020 it only dropped 20% and bounced back within 3 years.

Where do you chicken littles come from? Lol

and I fully expect the stock market to crash, effectively wiping out my 401k.

You only lose money if you sell. Those who were able to stay the course after '08 made it all back and then some.

The risk is a huge crash right before you retire, or you have to pull from your 401k to fund living expenses.

That’s very pessimistic.

Not for the entire southwestern United States. There’s 5 major cities off the top of my head getting ready to face a zero day. If you don’t think the stock market is going to react when that happens…

What’s a “zero day” in this context?

Zero day is the day a city runs out of water and must literally truck it in.

Gotcha, thank you!

I call it realistic. If you think everything is going to work out, you’re delusional, man. But I hope you prove me wrong some day, I really do.

Yeah, I’m not going to live my life like that.

Same exact boat. Zero confidence I can retire. My best case plan is to move to South America at so. E point and hope I can make it until I die.

Weird flex, but ok

He’s lying.

I’m almost exactly same as you and you’re full of shit.

If you’re honestly making 100k with no debt and one mortgage around 300k you can save 2k a month if your wife makes a decent wage.

Who said they have a wife?

Am millennial… xenniel or “elder millennial to be exact… I have completely given up on ever owning a home or being able to retire. Short of some major acts of public disruption at unprecedented, economy-toppling, billionaire-eating scale, my entire generation - and those after us - are fucked.

And yet we act like boiled frogs, each generation making fun of the prior one for expecting things to be better than they are. Gen z is so used to things being like shit that they think that all older generations are entitled fuckers And that we should get used to everything being worse because Right now it’s the best they’ve ever known.

You only need like 5% down for a home. Zero if you are a veteran for some reason. Mortgage is almost always cheaper than renting.

Unfortunately, this age-old folk wisdom just isn’t true any more.

Near Los Angeles (and many/most big cities these days) even “fixer-upper””starter” homes cost $1,000,000.

5% down ($50k) would result in a monthly mortgage payment of $7,939.88 which more than twice my rent payment, which is already high.

And saving is nearly impossible given the rate at which the basic costs of living (including rent) have skyrocketed in recent decades.

It worked for me last year. Put 5% on a home near a major city, purchase price $425k

Some areas like LA are just a special kind of fucked, but you don’t have to live there.

The lesson here is do the calculations for your area. There are a lot of “buy vs rent” calculators online.

Yeah, I bought fairly recently (as interest rates were starting to climb) and it was 100% a qol decision rather than a financial one. I’m paying more in interest now than I was paying in rent before, so instead of giving my money away to a landlord, I’m giving it away to my mortgage company.

The only way I’ll come out ahead financially is if the value goes up. But I have mixed feelings on that, too, because the housing situation is fucked here and value continuing to go up will mean that the situation is still fucked. I don’t want this place to be my home forever, so if the price here goes up, then the price of better places will also go up and it ends up being a wash until I don’t need to own and can sell, but even that would be tough because inheritance is probably going to be my daughter’s only way of ever owning her own place.

Or, on the other hand, if they fix the housing issue here by limiting the number of residences any person can own and barring corporations from owning at all (or at least not having them count as new people for number of places they can own), then prices will crash and most people who currently has a mortgage will end up owing more than their house is worth and will still be fucked in that way. Unless the government makes the banks eat some of that or does a bailout for homeowners.

But anything in the above paragraph would probably take a revolution to actually happen because all of these bugs for regular people are features for those that have the wealth to influence the political power.

Or best option, rather than a crash we massage the housing market into stagnation for a decade or two with a combination of increased supply and gradual regulation. Stagnation in housing prices will over time let wages catch up.

Even at 425 PMI is killing you to the tune of an extra 300/ month

$61/mo actually.

Zero down also for USDA home loans

LOL I’m never retiring. I’ve already accepted that I’ll be working until I’m dead. There are those who get dealt the right cards and will get to retire comfortably. I’m just not one of them.

Hell. Gen X also are worried about retirement.

Will social security be here in 15 years? My 401k has not kept up at all… Everything today costs soooooooo much there’s no real room for saving.

Right??

Early Gen Z / very tail end of millennial here.

Got a job that pays ~80k (with promotion potential to 100k in a year) and I’m just… dumbfounded at how yall are making it. I didn’t grow up wealthy at all, and struggled with homelessness for a time, so I’m not new to the frugal game, but being able to put away only a hundred or two bucks a month after taxes is crazy with the hours and time I put into existing. I’d rather just not work at all if the end result is the same.

Doordash is a crux in my life and something I’ve definitely splurged on in the past, but groceries are just as expensive outside of rice beans and chicken. Baffling. :(

being able to put away only a hundred or two bucks a month after taxes is crazy with the hours and time I put into existing.

Every little bit helps. Future you will thank you for even putting that amount away.

I try, but of course life finds a way to rip whatever savings I’ve got slowly but surely.

At this point, I’m still looking at working till the day I die.

What do you invest your 401k in?

For the last 10 years when I’ve been asked about my career goals during job interviews I always respond, “I would like to retire.” I then clarify that I don’t mean tomorrow, next year, or even 5 years down the road. I just don’t want to die a wage slave.

You won’t retire, no. No longer work a job because everything is slowly falling apart as our climate apocalypse trudges on? Sure, but you’ll still be working hard to survive.

No.

But one day I will get so desperatly poor that taking out someone in siphoning wealth from the country and ending them might seem like a fitting end.

If we don’t change things anyways.

I always wonder why people shoot up schools and parks when their problems are caused by people in board rooms. Never see a mass shooting in a board room for some reason.

Believe it or not, people willing to murder others aren’t the best at thinking clearly.

“Those who make peaceful revolution impossible will make violent revolution inevitable.”

- John F. Kennedy

Let’s make peaceful revolution possible by campaigning for electoral reform at the state level! We should all be free to vote for those who best represent us, secure in the knowledge that our vote will still be cast against those we don’t want in office.

We don’t need to wait for trump to have a hamburger heart attack, we dont need to wait for the republicans to stop existing. We can do this right now… and some states already have!

Yours can to, most especially the blue states. Who is stopping you in those blue states?

Alas, I do have a plan involving retirement. It is filed under “things that happen to other people”.

The probability I’ll survive to retirement age is negligible, why worry about it?

she has about $75,000 saved up for a downpayment

Oh you poor child. That’s not even close to enough. 💀

It’ll get somewhere just north of half a million.

So a two bedroom condo. Probably not what most people had in mind for that much work.

Yeah that’s about it where I am but in other places that’s a 2b/2b house with a half acre yard, which isn’t horrible.

I guess that means you can add on to the house. Like one of those shanty towns.

It is tho. 75k gets u closed on a 300k house with 20% down basically

Gonna leave a bit of advice for any young folks that might see this. Something I wish to god someone had told me when I was 20.

Start an annuity plan. They’re generally stable, all but guaranteed to accrue money. You can set a percentage of your paycheck to be deposited automatically into the account. If you have the option to do this through your employer, do it, find out if they match the deposit like mine. Put 10% of your paycheck in there. After 10 years, I have $40,000 sitting in a retirement account with a progressive series of bonds set to mature in between now and my retirement age. Those bonds will roll back into shorter term bonds as they mature, and add more value to the account. My projected retirement age is still 72, but at least I know that money is there.

Also, after 4 years, the account matures and you’re able to borrow against it, like collateral for a loan. So if I wanted to right now, I could take that money and use it as a down payment on a house. I’ll be expected to put it back, but the interest is generally lower than a home owner’s loan.

Generally speaking in the US annuities are horrible and significantly underperform a regular 401k/IRA invested in a broad total market index fund. The fees eat you alive. Don’t know how it is in other countries. But annuities here are damn near fraud.

Annuities have been bad because they invest in bonds and interest rates have been very low in recent years.

Over the next 10-20 years stocks could crash and rates increase.

I mean, if this is what you believe, you can still invest in bonds in a 401k or brokerage account. Even if I believed this about stocks crashing, I still wouldn’t put any $ in an annuity.

Also, predicting the stock market and making huge decisions based on that tends to not go well.

The main benefit of an annuity over bonds is that it will keep paying out until you die.

A small annuity that just covers you and your spouses essential living expenses is not a bad investment.

I agree, large annuities are a waste.

This sounds a lot like superannuation that we have in Australia and is mandatory. A certain amount of money from your paycheck is put with a super and they invest it for you, and the idea is that you should have a few hundred grand by the time you retire.

In the US that was Social Security but currently it’s broken

My plan is “hope the afterlife is real and then be a spooky ghost”

Of course I’ll retire, when I can no longer get a job, and that time is coming up fast. I only hope it’s not until I get my teens through college and off to a running start. I don’t see how I can afford to keep my house or even continue to live in this town, though

I’m not sure I agree with the narrative about being worse off by generation, though, because it is so tied to what you do. I’m a little sad about my older son starting adult life “in hard mode”: i’m proud that he wants to teach, and we live in an area with generally better teacher pay, but he’ll never earn much. It has certainly made my life easier to be paid better as a software engineer, even if circumstances mean I’m not financially able to retire. He’ll almost certainly live with less, have fewer opportunities, purely by choice of career, and without regard to his generation. Tack on the excessive housing inflation and his desire to stay in a hcol state, and I can’t help but worry for him

This is another one of many things that the government should be taking care of for people (and they sort of tried to with Social Security) but of course the “privatize everything” sociopath elites killed that idea, and our culture expects everyone to just learn how to Warren Buffet better. Bro, do you even index fund?

Retire? Nah when I’m done with life I’m just going to blow my brains out all over a politician or millionaire hedge fund manager.

They want to fuck over my future, I’ll take their sanity and gift wrap enough PTSD that every sleep is a nightmare.

I like your idea

Optimism is thinking they’d even get PTSD. Nah, they’ll just be like “stupid millennials have crossed a line”